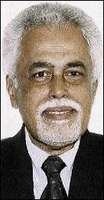

Left: Kent LaCroix, president of the Automoblie Dealers Association. Right: Kenneth Shaw, immediate past president of the Used Car Dealers Association.

Motor vehicle imports are on track to tumble to a four-year low, forcing some dealers out of business, with 20 such exits over the past year, while others are taking on new business lines to subsidise core operations.

For the first eight months this year, car imports have ranged from a low of 465 per month to a high of 771, with the cumulative number brought in being 5,025. At this rate, the sector is likely to end the year with just about 7,537 motor vehicles being imported, less than half of last year's numbers.

Car dealers, meantime, say there is a hold on imports and no new orders will be placed before February 2010, according to Kent LaCroix, president of the Automobile Dealers Association (ADA), which comprises 20 new-car dealers, representing 22 manufacturers.

Dealers were banking on the Bruce Golding administration's 20 per cent reduction in the special consumption tax (SCT) on vehicles to create some breathing room for the sector and punch up sales of inventory in bond and on their lots. However, a month into the initiative, it has done little for the car market.

ADA members are said to have a combined 1,100 vehicles in bond, with about 600 of them available for purchase.

'Glitches in the system'

"One would have hoped that with the package we would have seen a significant turnaround in terms of the sales. This has not yet materialised; the reason being that there were glitches in the system and there were some unsure matters as it relates to the classification," said LaCroix.

Market data show that the downward spiral in the auto business can be traced back to 2005, when a total of 29,116 motor vehicles, or an average of 2,426 per month, rolled off the wharves. The numbers fell to 21,784 in 2006, then to 19,785 imports in 2007 and 15,932 in 2008.

"No prudent dealer is going to order stock on top of stock that is already sitting down," said LaCroix.

He was among the more optimistic industry representatives when the duty cut was first announced by the Government last month but has since grown increasingly vocal about the ineffectiveness of the measure.

"It will take a while for things to return to the kind of numbers that (will enable) dealers to return to some profitability, because a lot of (cars) we had have been discounted heavily - separate and apart from the reduction in SCT," the ADA president told Wednesday Business.

"Dealers are discounting far more heavily than the SCT is offering," he added.

The Government's stimulus package saw, since September 10, the abolition of duties on imported vehicles already in the island with less than 1600cc rating and which previously attracted a 10 per cent duty.

Vehicles with 1600cc rating and upwards attract between five and 35 per cent duty. The 70 per cent duty on high-end sports utility vehicles, for example, was halved. The measure will run until March 31 next year.

The 'economic downturn'

New-car dealers say they are willing to ride out the economic downturn, and expect no big shakeouts in the sector.

There is, however, talk that one dealer is trying to sell, that there is a shift in the representation of different brands.

Issa Transport Group, for example, has already given up its distributorship of Audi. A new dealer has not been announced for the luxury brand, though a deal is said to be pending finalisation.

Used-car dealers, however, are under greater pressure and at least 20 of them have exited the market.

Last year this time, there were about 134 dealers, but now there are 114, said Kenneth Shaw, quoting Trade Board data.

"Industrywide we are down to about a 55-60 per cent decline in business," according to Shaw, who up to last Thursday was president of the Jamaica Used Car Dealers Association (JUCDA). He has since been replaced by Ian Lyn, head of marketing at New Line Motors.

LaCroix said that while sales were down last month over previous months, he was looking forward to some semblance of a recovery in sales numbers by November.

Forced to 'get creative'

However, there appears to be no such glimmer on the horizon for JUCDA members, forcing them to get creative with services.

Shaw, for example, said his dealership, KACS Auto Sales, has been converted into what he has described as a one-stop auto centre, offering air condition servicing, body repairs, tinting, alarm and radio installation. To do so he has had to bring new staff on board.

For KACS, the importation of vehicles has been narrowed to special orders or simply replacing what is sold.

"I have had to diversify my operations significantly in order to compete," said Shaw.

"We have not replaced anyone that has left our employ and are even taking a reduction in salaries to see a better bottom line."

LaCroix, meantime, says that not only has the 'vehicle stimulus' failed to cauterise the bleeding of the sector, it has emerged as a case of "enlightened self-interest", and an enrichment of the Treasury.

Under the new arrangement, he said, the Government coffers will see a net flow of roughly $1.2 million from the sale of each vehicle for which the landed cost is $1.42 million, whereas last year the same revenues were underperforming.

Shaw, too, said that with most of his members having no bond facility, which in such a case requires the payment of duties upfront, the stimulus package is of no benefit to used-car dealers.

mark.titus@gleanerjm.com

Used cars on a dealer's lot in Kingston in 2006. - File photos