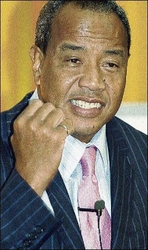

Michael Lee Chin, bilionaire investor, is expected to get the nod from bondholders on June 18 to extend the maturity of the debt to November 27. - File

Following what sources say was a somewhat stormy meeting with bondholders in Kingston last Friday, billionaire Michael Lee Chin's Caribbean holding company, AIC Barbados (AICB), seems set to get the nod from the Jamaican investors, separate sources say.

AICB, having failed to lock up a buyer for its stake in Columbus Communications, has asked holders of its notes to wait until November 27 to recover billions of dollars they have tied up in AIC bonds the company is unable to honour.

If they agree, it would have delayed redemption of some US$37.7 million worth of the bonds by eight months.

"I think the investors came to the conclusion that the prudent decision would be to approve the resolution for the extension of maturity," an industry source close to the issue said.

Another similarly said bondholders will give their nod next neek.

Good meeting

Investors normally have several days in which to indicate their decision to the trustee; in this case, they have two weeks from the June 5 consultation.

"The meeting went very well and I thought the overall mood was good," a PCFS representative told Wednesday Business.

"The noteholders have until June 18 to decide whether or not to approve the resolution. The 13.25 per cent (interest on the bonds to November) is the same rate that was agreed at the last refinancing. The investor base is across all classes of investors."

PCFS in a June 8 circular sent out to bondholders, and acquired by Wednesday Business, the trustee has refrained from making a recommendation on whether to accept the AICB proposal put forward by Robert Almeida and his boss Lee Chin, saying there were "other matters" to consider "before any definitive resolution is presented" for their consideration.

Emerging consensus

But the securities firm also pointed out to noteholders who were absent from the meeting that while no vote was taken Friday, "there was no dissent to the proposal from the floor that the resolution be amended to reflect what appeared to be emerging consensus of a further extension" of the maturity date.

Indeed, PCFS said those in attendance indicated that "cooperation with AICB may be desirable" because of the enhanced security offered by AIC, reasonable prospects for the sale of the Columbus shares, and Lee Chin's assurance that the obligations of AICB would be met, among other reasons.

There are some US$108.39 million AIC bonds at play, of which a total US$56.9 million mature this year.

The rest matures between January 2010 and April 2011.

Four redemptions were originally due in March and one in April; another becomes due in July and another in December

The first four maturities, on the agreement of some 150 noteholders, were extended to June 11, a date AICB now says it cannot keep.

It is understood that investors have been receiving interest payments.

Lee Chin's Caribbean investment vehicle has been hit by a fall-off in earnings so far this year, and was plagued by a shortage of cash, falling net worth and significant foreign-exchange losses to December 2008.

Since March this year, dividend income from AICB's roughly 60 per cent shareholding in National Commercial Bank (NCB), from which it earns the bulk of its income - 94 per cent in the quarter to December - goes to a dividend account under the control of the Pan Caribbean as bond trustee.

Collateral upgrade

Robert Almeida, head of AIC Global Holdings, joined his boss Michael Lee Chin to persuade investors to wait another five months for their investment to mature.

This was part of a US$60-million collateral upgrade which AICB was required to make.

Its 20 per cent shareholding in Columbus, a Caribbeanwide fibre optic cable business, and its NCB Towers real estate in New Kingston were also pledged at the time.

Lee Chin plans to make restitution on the bonds by liquidating his 20 per cent Columbus holdings, on which a sale is expected by September.

To clear its total debt of US$155 million (J$13.8 billion), AICB is hunting between US$200 million and $300 million which it says is the value of the Columbus shares.

At that value, the shares are worth about three times or more the US$80 million that Lee Chin, earlier this year, told this newspaper he paid for them five years ago.

AIC officials reportedly told investors last week that six bids are in hand through brokers of the sale, Royal Bank of Canada.

huntley.medley@gleanerjm.com